Raymond Gay is a CERTIFIED FINANCIAL PLANNER™ and works with Fiduciary Wealth Management (www.fiduciary-wealth.com). Ray and Wendy met as classmates during an MBA program at James Madison University. They recently spoke about ways to turn the GameStop news into a teachable moment for students.

Wendy: Ray! GameStop is all over the news and students are paying attention – what can we learn from this market frenzy??

Ray: Well, students are not the only ones who enjoy video games, but, yes, it does have their attention! Here’s some background:

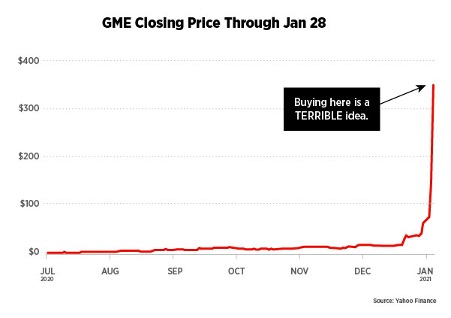

GameStop is a brick-and-mortar video game chain that hit hard times in the pandemic. Like many distressed companies, it was targeted by short sellers betting that the stock’s price would go down.

Wendy: Whoa whoa whoa – break this down for me, Ray, so we can make this a valuable finance lesson for young people. Tell me about short selling.

Ray: Basically, short sellers do the opposite of most investors. Most investors want their stock price to go up. Short sellers’ strategy is to make money when a stock’s price falls. They borrow shares from their brokerage for a fee, immediately sell them, and plan to buy them back later at a lower price when the price falls. Shorting is typically a strategy used by certain types of hedge funds that focus on finding companies that they perceive as being overvalued.

Wendy: That strikes me as illogical. What am I missing about this strategy? Isn’t it risky?

Ray: Yes, it is very risky. Though there is risk with any investment we make, shorting stocks is particularly risky since any positive news or interest in a company can drive the stock’s price up and there is no limit to how far up a stock can go. Normally when we buy an investment, our risk is that the money we invested decreases in value and the most it can decrease is to zero, so our risk is limited to what we invested. But when we short a stock, our risk is that the stock goes up in value and there is no limit to how high a stock price can go. So, with shorting, you have the risk of losing more money than you invested into the trade. When short sellers bet wrong and a stock’s price rises, a short seller will be forced to buy shares at higher prices to cover their losses (or pony up more collateral).

A squeeze happens when short sellers scramble to buy shares to cover their positions when the stock price is rising. The more investors who buy and hold those shares, the harder it is for short sellers to find shares to buy and the greater demand for the shares increases the potential share price (exposing them to potentially huge losses).

With me so far?

Wendy: Yes. That’s good background information and you’ve given some clarity on the strategy. So, where does Reddit come in?

Ray: Reddit is a popular community of chatrooms and forums. After it became clear that short sellers were betting on GameStop’s demise, the company became the focus of amateur traders on the popular WallStreetBets forum on Reddit. News spread quickly.

By banding together and coordinating buying activity, small-time traders boosted the stock’s price far above what the company’s financial fundamentals support, putting pressure on the hedge funds betting the other way.

The stock went viral.

Wendy: That’s a powerful narrative at play, Ray. What about the legality of it? Is it illegal?

Ray: Is it illegal? That’s a stretch. These armchair traders are egging each other into speculative bets, but I don’t think it rises to the level of illegal market manipulation. However, regulators might feel differently.

The other question to ask is: Is it bad for markets? The battle between gleeful amateurs pushing prices up and hedge funds scrambling to force prices down has led to some of the highest volume trading days on record and cost short sellers billions.

I think a lot of these small traders are angry at the perception that All-Powerful Wall Street is pulling strings and using their connections to hurt mom-and-pop investors. They see this as an opportunity to combat the big-money pros by using their own strategies against them.

It’s new school vs. old school. Rebels vs. the Empire. Bueller vs. Principal Rooney (I just aged myself). Reddit vs. CNBC.

Ultimately, we expect investments to perform based on their fundamentals. In the most basic form, these fundamentals should be influenced by the internal operations of the company and overall economic climate. What is most concerning to me regarding Gamestop is that it had nothing to do with fundamentals. It was purely speculative and that can be very dangerous for any investor.

Wendy: Good analogies, Ray. Maybe you should be a teacher?

Ray: I’m not so sure about that, Wendy, but I would invite teachers and students to expand the conversation. Candidly, it’s pretty wild that a bunch of regular folks with small trading accounts can bring massive institutional investors to their knees. It’s really a learning opportunity for people of all ages and all interests. I’d start with these questions:

- Will social media traders continue to drive big market moves?

- Are coordinated moves by small investors a danger to markets?

- How does the everyday person identify opportunities to invest?

- https://www.morningstar.com/articles/1019249/what-the-heck-is-going-on-with-gamestop

- https://www.marketwatch.com/story/gamestop-stock-has-another-volatile-trading-day-with-more-price-spikes-and-trading-halts-11611686411

- https://www.ft.com/content/56658052-76fe-4910-8cb7-810039753f7c

- https://www.reuters.com/article/us-retail-trading-shortbets-idUSKBN29X1SW?taid=6012f37e9ac87d000147d4e3&utm_source=reddit.com